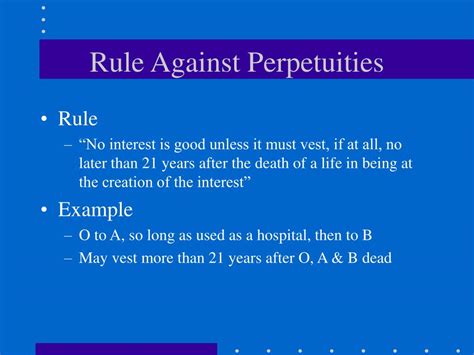

Rule Against Perpetuities Explained

The Rule Against Perpetuities (RAP) is a complex and often misunderstood legal doctrine that affects the creation and management of trusts and estates. It is a rule that dictates how long a property can be held in trust before it must be distributed to its beneficiaries. The RAP is designed to prevent property from being tied up in trust for an excessively long period, thereby limiting the ability of future generations to manage and dispose of the property as they see fit. In this article, we will delve into the intricacies of the RAP, exploring its history, key concepts, and practical implications for estate planning and trust administration.

Key Points

- The Rule Against Perpetuities is a legal doctrine that limits the duration of trusts and estates.

- The RAP is designed to prevent property from being held in trust for an excessively long period.

- The rule is based on the concept of a "life in being" plus 21 years.

- Violations of the RAP can result in the trust being deemed void or subject to reformation.

- Modern estate planning techniques, such as the use of "wait and see" doctrine, can help mitigate the impact of the RAP.

History and Development of the Rule Against Perpetuities

The RAP has its roots in English common law, dating back to the 17th century. The rule was originally designed to prevent the creation of perpetual trusts, which were seen as a threat to the feudal system and the concept of landed property. Over time, the RAP has evolved and been refined through judicial decisions and legislative enactments. Today, the rule is an integral part of trust law in many jurisdictions, including the United States.

Key Concepts: Life in Being and Vesting

The RAP is based on two key concepts: the “life in being” and the idea of vesting. A life in being refers to a person who is alive at the time the trust is created. The rule states that a trust must vest, or become possessable, within 21 years after the death of a life in being. This means that the trust must be distributable to its beneficiaries within a certain timeframe, ensuring that the property is not held in trust indefinitely.

| Concept | Definition |

|---|---|

| Life in Being | A person alive at the time the trust is created |

| Vesting | The trust becomes possessable by its beneficiaries |

Practical Implications of the Rule Against Perpetuities

The RAP has significant practical implications for estate planning and trust administration. Failure to comply with the rule can result in the trust being deemed void or subject to reformation. This can lead to unintended consequences, such as accelerated taxation, loss of control, and disputes among beneficiaries. To avoid these consequences, it is essential to carefully consider the RAP when creating and managing trusts and estates.

Modern Estate Planning Techniques

Fortunately, modern estate planning techniques can help mitigate the impact of the RAP. For example, the use of “wait and see” doctrine allows trust administrators to delay distribution of the trust until the beneficiaries are known, thereby avoiding potential RAP issues. Other techniques, such as the use of discretionary trusts and beneficiary-controlled trusts, can also provide greater flexibility in trust administration.

What is the purpose of the Rule Against Perpetuities?

+The purpose of the RAP is to prevent property from being held in trust for an excessively long period, thereby limiting the ability of future generations to manage and dispose of the property as they see fit.

How does the RAP affect estate planning?

+The RAP requires estate planners to carefully consider the duration of trusts and estates, ensuring that they do not exceed the permitted timeframe. Failure to comply with the rule can result in unintended consequences, such as accelerated taxation and loss of control.

Can the RAP be avoided or mitigated?

+Yes, modern estate planning techniques, such as the use of "wait and see" doctrine, can help mitigate the impact of the RAP. Additionally, the use of discretionary trusts and beneficiary-controlled trusts can provide greater flexibility in trust administration.

In conclusion, the Rule Against Perpetuities is a complex and often misunderstood legal doctrine that affects the creation and management of trusts and estates. By understanding the history, key concepts, and practical implications of the RAP, estate planners and trust administrators can navigate the complexities of trust law and ensure that their clients’ interests are protected. With careful planning and attention to detail, it is possible to mitigate the impact of the RAP and achieve the desired outcomes for beneficiaries.